The goal of each and every one of us is to increase our net worth as much as possible. We put up these four simple steps that you can take to increase your net worth.

- Pay off your debt: Take out time to review all your liabilities. Look at your debt which service each month, these may include your mortgage, credit card debt, and loan payment. Are there anyone you can pay right now or reduce? This step will help you increase your net worth. If you find it hard to pay at once, consider creating a payment plan. you may choose to do this weekly or biweekly payments instead. This can help to reduce the principal faster, in turn reducing the total amount of interest you pay.

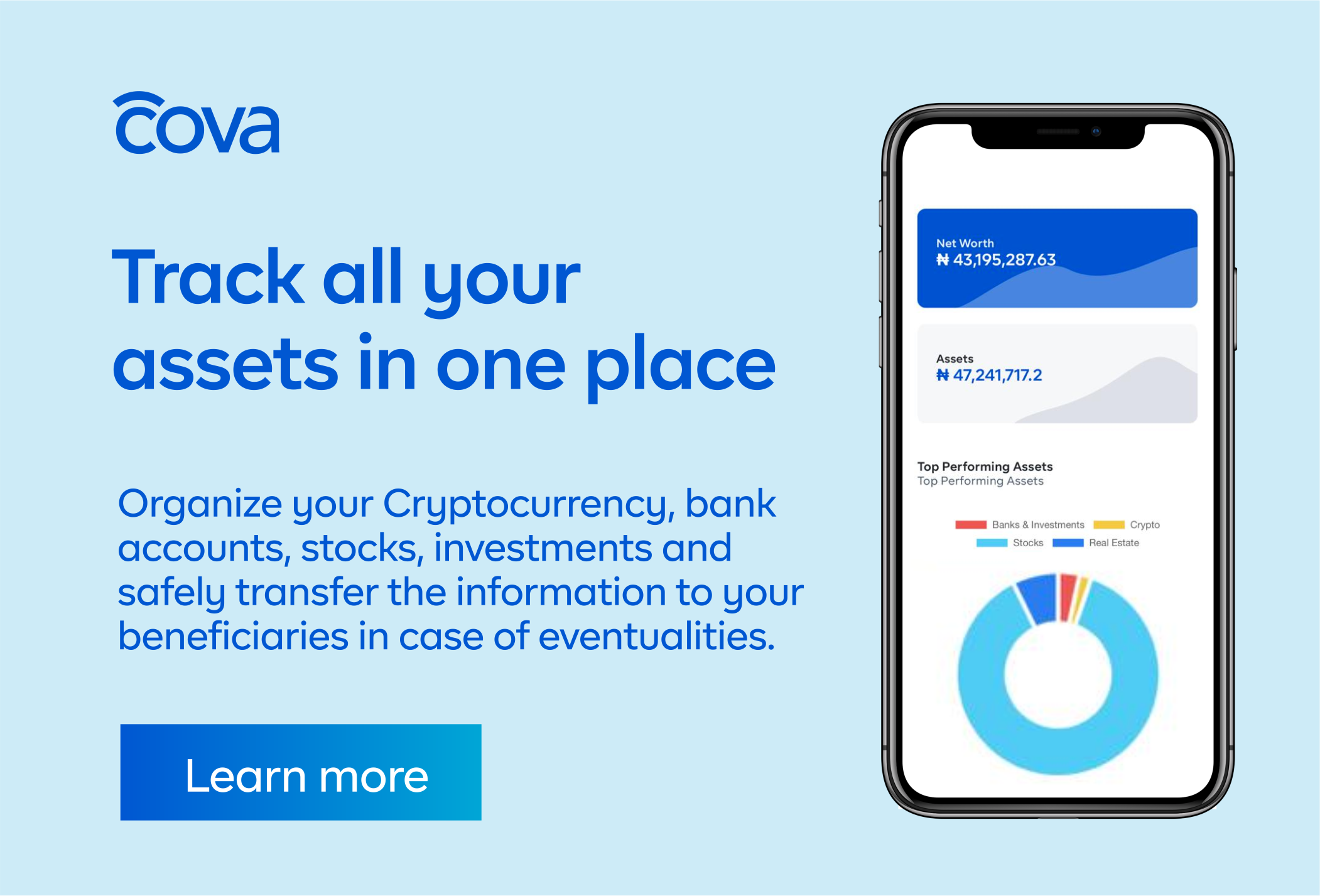

- Track your assets: Your assets are the best ways to increase your net worth. Chances are you don’t know the exact worth of all assets are worth, but you can get an estimated figure. Try not to leave any assets out. Use a tool like Cova to put everything into perspective. Start with assets whose values are easy to decide and update. For example; your bank accounts, stocks, investments, funds in wallet apps, investments apps, your pension and retirement accounts, mutual funds etc. Track your crypto accounts and the value of your crypto assets. Don’t forget your paintings and arts, cars, vehicles and personal belongings, try to put an estimated value on these using market data. Add real estate and other properties. By the time you are done, you would be surprised what you own. Now ensure you track and update these assets monthly.

- Cut down on your expenses: There are two ways to increase your wealth. Make more more and spend less money. Look through your monthly expenses and find the ones you can do without.

- Double down on the assets that are increasing your net worth: If you track your assets efficiently, you would discover the assets that are growing in value and those that are depreciating. Move more resources towards your growing assets. Cova’s asset tracking tool does more than estate planning. It helps you track your assets in one place.

- Convert depreciating assets to appreciating assets: Move cash sitting in your checking account to mutual funds that return higher interest rates. Converts cars that you are not using to cash and put the funds in investment vehicles that deliver high returns. Get al your assets to work. No room for lazy assets.